Obtain Quick Accessibility to Budget Friendly Finance Solutions for Your Financial Demands

Whether it's for unanticipated expenditures, financial investments, or other financial commitments, having accessibility to affordable and rapid funding choices can give much-needed relief. Understanding the various kinds of lendings available, the qualification needs, and how to contrast rate of interest prices and terms can make a significant difference in your economic health.

Advantages of Quick Gain Access To Loans

Quick gain access to loans offer individuals with prompt monetary assistance in times of immediate need, providing a convenient remedy to unforeseen expenditures. Conventional lending applications frequently involve prolonged authorization processes, whereas quick accessibility car loans usually have minimal documents needs and quick authorization times, in some cases within the same day of application.

Another advantage of fast accessibility finances is their versatility in terms of usage. Debtors can use these funds for a variety of functions, including medical emergencies, cars and truck repair work, or unanticipated bills. Unlike some conventional fundings that have restrictions on exactly how the borrowed money can be invested, quick access loans supply debtors with the freedom to address their most important economic demands.

In addition, quick gain access to financings can be a useful device for individuals with less-than-perfect credit history. Numerous standard lenders might refute lending applications based upon credit report, but quick accessibility financing carriers typically consider other variables such as earnings and work status, making them a lot more accessible to a larger series of borrowers.

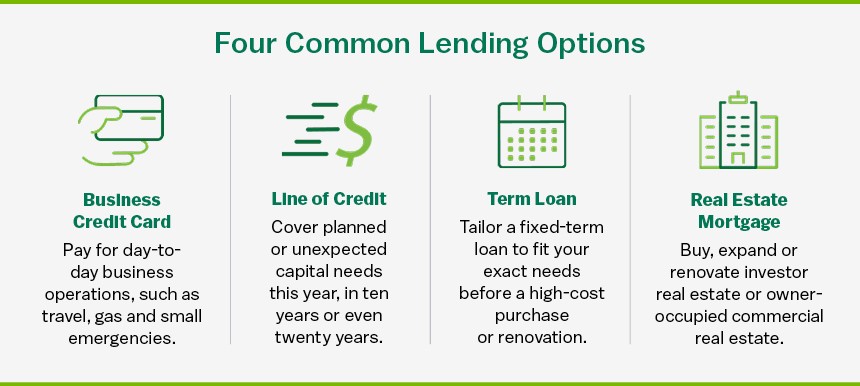

Types of Affordable Funding Solutions

Among the selection of monetary services readily available, affordable loan solutions include a variety of alternatives tailored to fulfill the diverse needs of debtors. Payday fundings often come with greater interest prices and charges due to their quick accessibility. Guaranteed fundings require security, such as a residence or a cars and truck, to secure the financing amount, resulting in reduced interest prices contrasted to unsafe fundings.

How to Get Approved For Rapid Car Loans

Lenders using rapid loans focus on these 2 aspects to examine the customer's ability to repay the loan without delay (loan ontario). A good credit rating background mirrors the customer's responsible credit rating actions, making them a lower-risk applicant for the lending.

Contrasting Rates Of Interest and Terms

When evaluating car loan choices, debtors need to carefully analyze the check that interest rates and terms offered by different lenders to make informed financial decisions. Additionally, borrowers ought to consider the terms of the car loan, including the repayment period, costs, and any kind of fines for very early settlement.

Contrasting rate of interest rates and terms can help borrowers pick a loan that straightens with their economic goals and capacities. Some lending institutions may use reduced rate of interest however impose more stringent terms, while others might have a lot more versatile repayment alternatives yet higher prices. By examining these elements side by side, borrowers can pick a finance that not only satisfies their instant financial demands however also fits within their lasting monetary strategies.

Tips for Repaying Loans promptly

Making sure prompt repayment of financings is vital for maintaining economic health and wellness and avoiding unneeded penalties or charges. To help you remain on track with your funding repayments, take into consideration establishing automated payments. By automating your repayments, a knockout post you can avoid failing to remember due dates and make sure that you never miss a settlement. Furthermore, developing a budget that includes your finance payments can assist you handle your finances much better and allot funds particularly for settlements.

Lastly, checking your settlement progress frequently can aid you track your remaining balance and stay inspired to remove your financial obligation (easy loans ontario). By carrying out these tips, you can guarantee that you settle your loans promptly and preserve your financial well-being

Verdict

In conclusion, fast accessibility to inexpensive funding solutions can provide valuable monetary assistance for people in requirement. On the whole, accessing rapid lendings can offer a practical service for managing monetary requirements effectively.

Typical finance applications frequently entail lengthy authorization procedures, whereas fast accessibility car loans typically have marginal paperwork requirements and fast approval times, sometimes within the exact same day of application. Unlike some standard finances that have restrictions on how the obtained money can be spent, quick gain access to lendings supply debtors with the freedom to resolve their most important economic demands.

Lenders offering quick loans prioritize these 2 aspects to assess the borrower's capacity Related Site to settle the finance quickly. Supplying up-to-date and exact monetary details during the loan application procedure can increase the opportunities of qualifying for rapid fundings.